Michael Ellis, Managing Director, EQ Riskfactor

Michael Ellis, Managing Director, EQ Riskfactor

The need to Know-Your-Customer is increasing. As is the challenge to implement processes that are compliant, efficient, but non-compromised in terms of customer experience. Here’s how to unify these needs and get the right balance throughout.

While organisations have become better in meeting their regulatory obligations, efforts to optimise this process typically focus on increased operational efficiency through greater automation. Less well known, but also an aid to straight-through processing, is KYC. Integrating KYC in the wider onboarding journey can reduce friction points at the start, during customer onboarding, and later on as part of business as usual.

Start at the beginning

When designing a KYC policy, firms should have an accurate view of their customer risk. A key purpose of any good business is to remain compliant with ever-changing regulation whilst providing the very best customer experience. This includes the start of the journey when, often, customers undergo drawn-out onboarding processes. This is sometimes worsened by the perception of KYC being a stand-alone section of the onboarding journey.

In the age of good governance, Know Your Customer (KYC) is essential in business-to-business conduct. It helps to reduce the risk of fraud at any point in the customer journey and demonstrates positive change.

Customers prefer a frictionless onboarding process when it comes to joining an institution. The account opening and product or service purchase must be completed fast and efficiently. The onboarding process can also serve as a key trigger point for banks seeking to use straight-through-processing to manage customer lifecycles and associated best-practice.

So, organisations have an opportunity to drive both customer satisfaction and efficiency gains. Importantly, this frees compliance teams later on, allowing them to concentrate on outlying, complex KYC cases.

Digital ID & V

Completing an identity check on a new client is a fundamental first step in any new business relationship. As mentioned, the account opening and product or service purchase must be completed fast and efficiently, with quick KYC onboarding crucial for shortening the time to revenue.

It makes sense for firms to invest in technology and processes that bolster both compliance and customer satisfaction. Businesses can make use of digital solutions that can verify biometrics, identity documents, and proof of life.

They can gain confidence that they are compliant with their KYC obligations in a fast, secure way which no longer involves slow and cumbersome collection of documents. With digital solutions, customers are made aware of the status of their application, within moments.

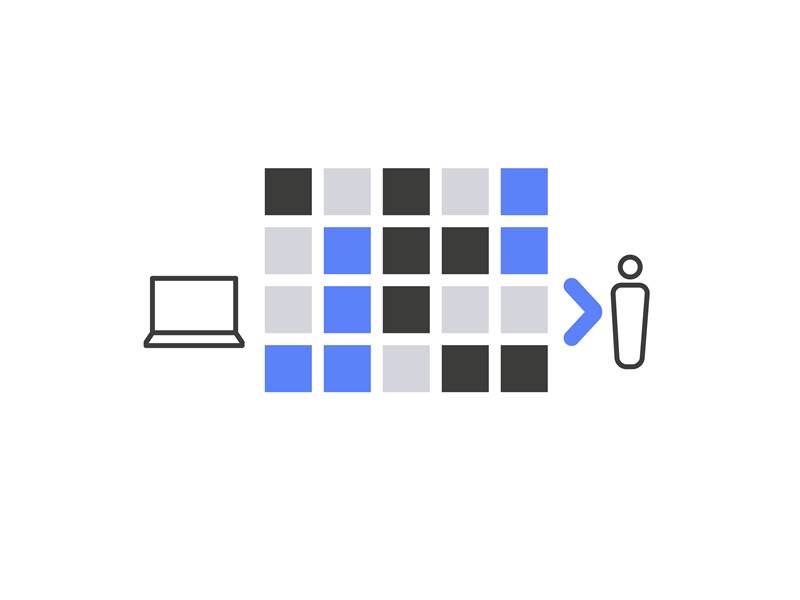

Digital ID & V serves to initiate both the KYC process and the overall customer onboarding journey. The same digital check can simultaneously trigger a KYC risk screening and collect personal data about the customer for ongoing lifecycle management. For simple cases (individuals, sole trader companies etc.) this data can be enough for near-instantaneous, straight-through-processing of onboarding, decreasing time to revenue for the organisation and creating a smooth experience.

Automation

Fast, accurate collection of customer data is a huge asset when performing KYC on corporate entities with complex ownership structures.

With Ultimate Beneficial Owner (UBO) structures now being collated in seconds by Artificial Intelligence (A.I.) tooling, having a customer verification system that matches these efficiency savings is crucial for fast onboarding of business clients.

Whilst digital Identification and Verification (ID&V) initially predominantly served the onboarding of individual customers, its importance for corporate clients is therefore critical. The more data that compliance teams have at an early stage, the better.

Purposeful. Regulated. Experts. We give customers breathing space.

What to Consider

Compile as much data early in the process, whether that is from the customer themselves (using Digital ID&V tooling) or from their business, for example with existing documentation from earlier onboardings.

Utilising additional data sources allows you to build a broader and therefore more accurate risk assessment when performing KYC.

Automating the onboarding process with increased straight-through-processing is not only quicker initially – it greatly reduces inconsistencies that would need to be addressed later.

Digital ID&V checks can be conducted consistently throughout the customer’s entire lifecycle. With an automated onboarding process, KYC obligations can be met and future screenings scheduled with little or no involvement from compliance specialists unless absolutely necessary.

By no longer treating KYC as a separate process, financial organisations benefit both themselves and their customers. Firms optimize both their 1st and 2nd-line operations (through better collection of data), with customers benefiting from less friction points throughout on-boarding and ongoing lifecycle management.

EQ Podcast on customer-centric KYC

Learn more about the careful balance of compliant and efficient KYC with positive customer experience.

For more about KYC, talk to the EQ Team or see the solutions we provide.

EQ are: Purposeful. Regulated. Experts.

This article is part of the 'Without Boundaries' series.