Login

Login

Services for Individuals

THE IPO REVIEW

Each quarter, EQ reviews both the UK and international IPO activity. The report provides readers with in-depth information on the latest listings as well as broader economic factors impacting the IPO market both in the UK and across the globe.

GLOBAL OUTLOOK

Paul Matthews, CEO, EQ Boardroom

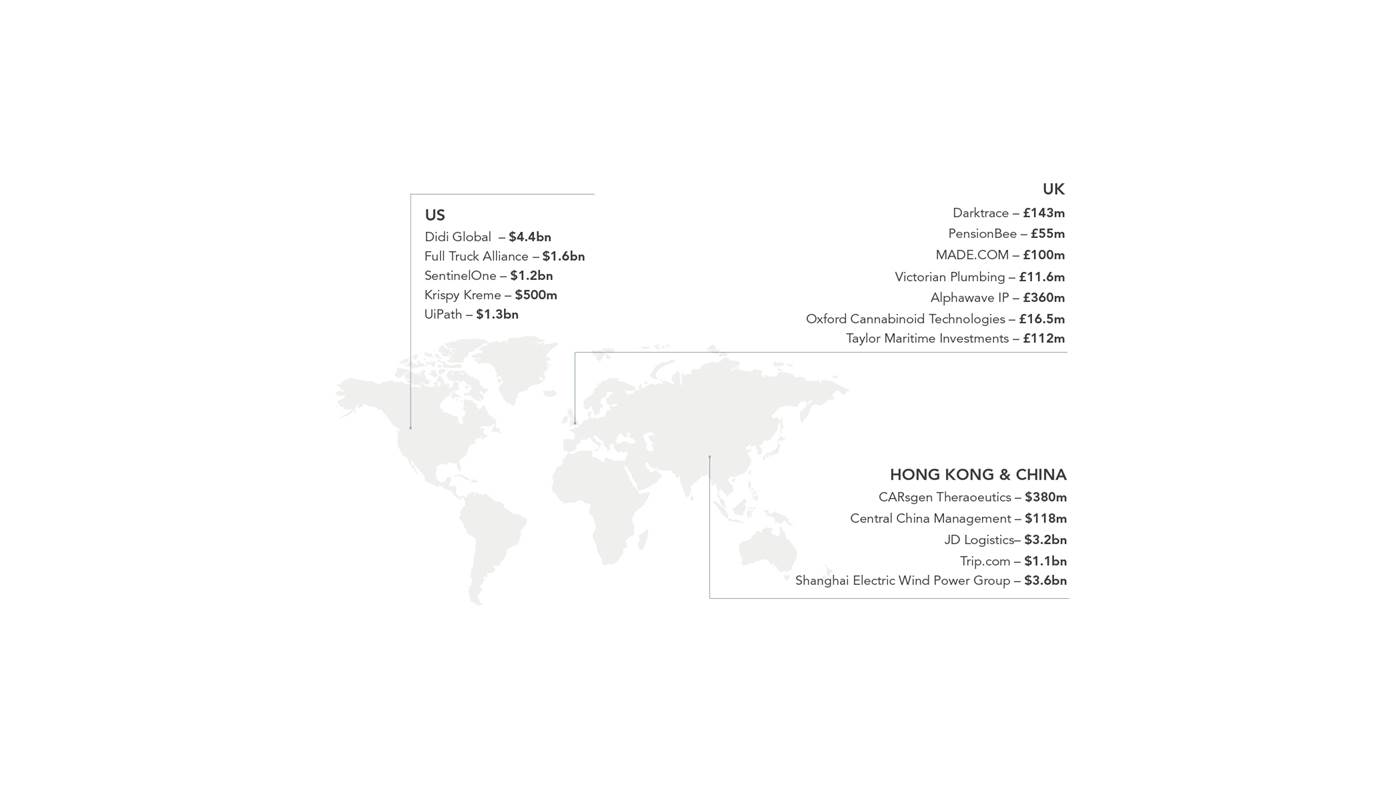

In Q2 we saw a healthy crop of listings in London, with strong representation across the tech and service sector with PensionBee and MADE.COM among those newly listed, whilst New York saw its strongest month since Covid struck with $25bn raised in June alone.

In Hong Kong and China we have begun to witness the effects of reining in tech giants with fines, anti-monopoly probes and laws around company’s data security policies, leading to delays in going public.

Across all markets we have seen a dramatic uplift in retail investors over the course of the pandemic. The sheer weight of retail investor’s money coming onto the market has raised questions about accommodating them better in IPOs, prompting questions from industry leaders.

Lord Hill’s Listings Report on the future shape of London’s IPO market is being examined in the context of very contradictory opinions on whether to liberalise or maintain standards. The clouds now forming over SPACs (see last quarter’s article) and regulatory tightening on tech listings in China suggest caution but the increasing draw of more relaxed New York and Amsterdam exchanges have led for calls to reform in order to compete globally.

More immediately, a bumper crop of companies went public with particularly strong representations from tech and services, helping to make 2021 H1 the strongest since 2014.

Darktrace

successfully raises

£143m

Pensionbee

investor support raises

£55m

MADE.COM

welcomed with raise of

£100m

Other highlights:

Taylor Maritime Investments is betting on a growth in world trade with a pipeline of second-hand cargo ship acquisitions totalling $500m, which it believes are selling at a discount of 30% to replacement value. The company is targeting an impressive 7% dividend for its new shareholders, who invested £112m, valuing the company at £180m.

Oxford Cannabinoid Technologies raised £16.5m, giving it market cap of £72m. The company is part of a joint effort with Oxford University to provide medicinal pain relief products and its backers are as diverse as US rapper Snoop Dog and tobacco wrapper Imperial Brands. The company aims to sell its first product in 2027.

Alphawave IP, who license IP to leading edge chip designers, launched onto the public market in mid-May. The IPO was the largest ever listing of a North American company on the London Stock Exchange and attracted £360m of new money on a valuation of £2.47bn.

Another successful London IPO was Victorian Plumbing which became the largest ever company to float on AIM. From a garden shed business in 2000 to £986m valuation today, the company employs over 500 people and overs over 24,000 bathroom products on its sites.

Companies have been eager to exploit renewed investor optimism this year. Healthcare, tech and online retailers have made up a high percentage of listed businesses and have seen this as prime time to float with Brexit and COVID concerns easing.

We can expect to see some nervousness in H2, particularly in the tech sector, where we have seen a few companies not perform as expected on floatation during the first half of the year.

Robin Walker, Business Development Director, EQ

The assembly line of Chinese and Hong Kong IPOs slowed after Beijing began to rein in the tech giants with fines, anti-monopoly probes and laws allowing the government decision-making rights on a company’s data security policies.

CARsgen Therapeutics

biopharma raises

$380m

Central China Management

lists on Hong Kong

$118m

JD Logistics

raises

$3.2bn

Other highlights:

JD Logistics raised $3.2bn in Hong Kong’s second largest float of the year after Kuaishou Technology. The delivery arm of JD.com has always been a separate entity from its mammoth parent and will use the money to further develop its technology and expand its 900 warehouses domestically and overseas.

Travel services are, however, alive and well in China. In what is thought to be a hedge against political and regulatory changes, the 22-year-old Trip.com dual listed in Hong Kong as well as New York, raising $1.1bn against a $21bn valuation. The firm is expecting record levels of Chinese tourism and double-digit growth on pre-pandemic numbers.

Shanghai Electric Wind Power Group listed on the SSE with much fanfare as part of China’s green power commitment. The company is China’s largest off-shore wind generator has a market cap of $2.5bn.

Despite the growing trend for Chinese companies to “come home”, New York was still buoyed by Chinese companies, impressive in number and size. This helped the exchange raise $25bn in June alone – its best month since Covid struck.

Full Track Alliance

rewarded investors raising

$24bn

SentinelOne

raised

$1.2bn

UiPath

robotics firm raises

$1.3bn

Other highlights:

The ride-hailing company Didi Global achieved a $67bn valuation and was second only to Alibaba in its $4.4bn raise. Investors appreciated the beginnings of profitability and the quick rebound from pandemic woes. However, within a week of listing, Beijing banned Didi from app stores and barred new registrations in a crackdown that will give further pause to the country’s tech companies and their potential shareholders.

Krispy Kreme achieved a valuation of $2.7bn for its second listing. Founded in the 1930s, the doughnut maker first went public in 2000 but failed to capitalise on a strong consumer following because of over-expansion and the failure of too many of its franchisees. Although loss-making, it presented itself as a Covid winner and its sales indeed grew 17% during 2020’s lockdown. But against the headwinds of strong chain brand competition and the trends towards healthier eating the $500m raise was below expectations and will not contribute as much as hoped to squaring its $1.2bn debt.

Listing in May were online job platform ZipRecruiter and medical protective clothing-maker FIGS. In an interesting reflection on the ebb and flow of pandemic perceptions, the recruitment company began trading positively then fell back during the quarter while the scrubs provider surged then lost value before nearly doubling in the course of June.

Outside of any new and creditable geopolitical risk that may spur negative volatility of the markets (as measured by the VIX) to slow things down, the global IPO market is poised to continue its record-setting pace into the second half of the year.

With so many in-progress de-SPAC transactions and traditional IPOs at various stages of completion, the IPO market is not showing any concerns of a slow-down even with the recent challenges coming from China and new concerns about COVID mutations.

Joe Conte, Head of Corporate Actions, EQ (US)

Lockdown has seen a dramatic uplift in retail stock market investment. Some newcomers have simply taken advantage of dips in traditional companies but others have pushed tech and biotech shares to astonishing levels with the weight of their numbers while others have collaborated on social media on trades that seem to defy any investment logic.

Does this broader participation merely represent a temporary distraction to the pandemic or an historic shift in the investor base that will lead to a fundamental change in market dynamics and how companies go public?

The weight of retail investors’ money coming onto the market is inevitably forcing questions about whether they should be better included in IPOs. This is important because of the potential for the first day “pop” or price spike which in the US has averaged 18.4% in the past 20 years and twice that in 2020. It is also timely because of the competition from SPACs allow retail participation on an equal footing with major finance houses.

RELATED ARTICLE: A SPAC Odyssey

In an open letter to the City Minister this year, the CEOs of AJ Bell, Hargreaves Lansdown and Interactive Investor jointly argued that “For too long, UK listings have been the preserve of financial institutions. Retail investors should have as much right as any other institution to invest at IPO, rather than having to ‘get in line’ and potentially buy the shares at a premium in the open market, post IPO. The UK taxpayer stands behind UK plc and should have unfettered opportunity.”

In the last three years, retail investors had access to only 7% of IPOs

When considering the letter, UK ministers and exchange regulators will be wary of appearing to fall behind other markets such as China, where retail investors already enjoy majority participation (albeit through a lottery system for often vastly over-subscribed offerings which give them a 0.05% chance of an allocation). US retail investors have until now only been able to tap into IPOs with a minimum of $100,000 but Robinhood is not alone in pioneering ways for its customers to participate in listings on day one, in their case by partnering with investment banks.

The lurking fear for regulators is that retail investors do not avail themselves of, receive or understand the necessary data to make informed decisions on potentially volatile IPOs.

Worryingly, a University of Chicago study on new entrants to the market found that they were statistically just as likely to ask friends and family for their thoughts on a share as they were to consult the company’s website.

On the other hand the pandemic showed that any and all communications can be managed very effectively when necessary and that investor roadshows in particular can easily be put online.

Given the regulatory requirements still in place in the US that limits retail investors to participate in traditional IPOs, many retail investors are heavily participating in direct listings and pre-de-SPAC shares or warrant purchases.

These two going public transactions have opened the doors to many retail investors, allowing them to be on the same playing field as VC and institutional investors in some capacity. This could explain why the SPAC market has and continues to be so active and successful in the US market and why some companies look to direct list their shares especially when these companies generate most of their revenues directly to a large consumer base.

Caitlyn Van Valin, Vice President, Capital Markets, EQ US

This year we have seen a real drive in companies looking to reach out to their consumer base to attract investor demand through the IPO.

We expect to see this trend continue, and companies need to factor in extended lead times for this. Businesses need to consider how they will communicate the offering to their customers, what actions they are asking new investors to take, clearly articulating the risks and rewards at each stage.

With more companies wanting to acknowledge the customers that have helped the business grow, we look forward to supporting these offerings in the future.

Robin Walker, Vice President, Business Development Director, EQ

Subscribe To The IPO Review

Each quarter, EQ reviews both the UK and international IPO activity.

The report provides readers with in-depth information on the latest listings as well as broader economic factors impacting the IPO market both in the UK and across the globe.

Register to receive these updates

DISCLAIMER

The report does not constitute a comprehensive or accurate representation of past or future activities of any company or its shareholders. All data and descriptions of any company, business, markets or developments mentioned in this report, may be a combination of current, historical, complete, partial or estimated data. The report may include statements of opinion, estimates and projections with respect to the anticipated future. These may or may not prove to be correct. This report is not, and should not be, construed as a recommendation or form of offer or invitation to subscribe for, underwrite or purchase securities in any company or any form of inducement to engage in investment activity. All information contained in this report has been sourced from publicly available information and has not been independently verified. Neither Equiniti nor any of its affiliates, partners or agents, make any representation or warranty, expressed or implied, in relation to the accuracy, reliability, merchantability, completeness or fitness for a particular purpose of the information contained in this report and expressly disclaim any and all liability.