There is a delicate balancing act to be performed this year. At one end of the scale, rewarding good performance through the pandemic and retaining high-quality leaders during a talent crunch. On the other, being sensitive to employees and the wider world when times are still tough.

In 2021, remuneration frameworks often went to the wayside. As most companies were cautious in their approach to executive pay, dividends and bonuses, there was less pushback than expected. Now that we are in a state of normalcy, it’s unlikely investors will continue to allow such leniency.

This year, companies have a better idea of their future, but we expect them to continue to be restrained. With a cost-of-living crisis emerging, some companies will give the same percentage increase as their workforce. Others will promote variable remuneration.

In cases where we see above inflation and workforce increases, retention is likely to be regularly cited as a key reason. The recruitment market is currently experiencing a well-publicised talent squeeze which some companies will react to.

Companies paying a dividend rose last year, from 48% in 2020 to 55% and we expect that trend to continue this year as businesses recover from COVID-19 issues1.

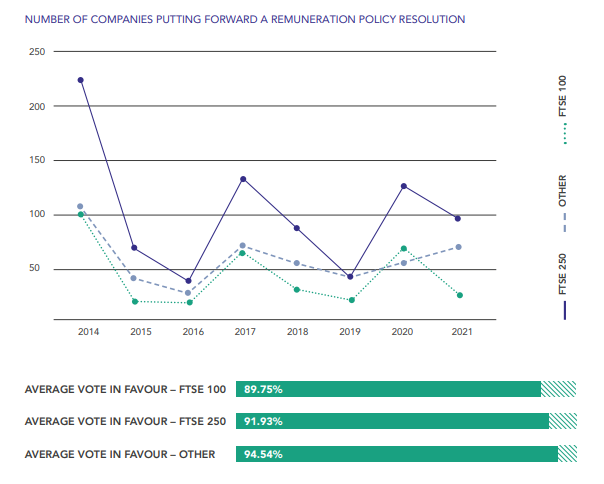

The number of close-call resolutions on executive remuneration increased last year2 and that trend could well continue. Any company that has received financial help from the government or where performance has been poor due to COVID-19 and dividends cancelled will struggle to find support in awarding bonuses or salary increases that are out of kilter with other stakeholder experiences. Investors will not hesitate to vote against remuneration reports and policies where this is the case.

When it comes to bonuses, remuneration committees will likely continue to use discretion to override formulaic outcomes, often to reduce it down so it doesn’t look disproportionate given the experience of the wider workforce. We expect there will be increases too because of outstanding performance in the current circumstances.

We’re seeing many more negative recommendations from proxy advisors on frameworks implemented through the Remuneration report. Decisions in this area are unique to each company in their particular environment, so investor engagement activity is rising to ensure companies explain why they have made the decisions they have.

With so many variables, the key in 2022 is explaining executive compensation decisions in the nuanced context of your unique company.

Executive remuneration tips for 2022

- Consider how to balance remuneration rises with employee pay, especially at a time when many people are struggling with the cost of living

- Be prepared to explain plans for repaying government money if anything is outstanding

- Consider if your Remuneration Policy remains fit for purpose, given the growing concerns around its implementation in the wake of the pandemic.

[1] & [2] EQ Snapshot Data