Environmental

Climate action will be a key focus this year in the wake of COP26, the introduction of the Task Force on Climate-related Financial Disclosures (TCFD) framework and as an investment in ESG funds continues to rise.

Investors want to feel confident that companies are taking action to improve their environmental impact. How are they meeting the four pillars of TCFD? What governance structures are in place? How are they performing against targets? We have seen some plans being put to an advisory vote and passed, suggesting boards are looking to make sure that investors believe their approach is on the right track.

Naturally, proxy advisors will look for disclosures against TCFD. They want to see board accountability for climate and sustainability matters or they will note it as a concern. Some will go even further, like PIRC, and recommend and abstain against the annual report, or ISS and Glass Lewis who may hold the chair of the board to account.

When it comes to the Section 172 statement, our advice in 2022 is to build on your reporting so far. Will proxy advisors recommend a vote against because of a lack of disclosure in this area? Potentially, if it’s coupled with other governance concerns or a lack of transparency and focus, that doesn’t mean it will be overlooked if companies take their foot off the pedal.

Investors are wise to greenwashing and want to see specific action, not words, with better reporting metrics. The Sustainability Accounting Standards Board’s accounting framework can help implement the TCFD disclosures and communicate financially material sustainability information to investors. Specific ESG metrics will also be put in place when the IFRS Foundation creates the Climate Disclosure Standards Board and the Value Reporting Foundation in June of this year.

In most companies, the CEO now has ultimate responsibility for climate risk1, not the sustainability, CSR or risk team. Further measures to show strong governance include establishing climate-focused subcommittees and appointing non-executive directors with specific experience in the area. And the obvious next step is to link CEO remuneration to delivering ESG KPIs.

If you make decisions outside of market practice or expectations, show why that is the right decision for your company. And make it clear who holds responsibility for delivering change.

— Anne-Marie Clarke, Head of Corporate Governance, Boudicca Proxy

Social

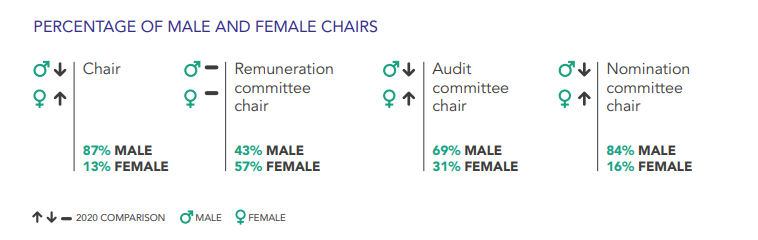

Diversity also continues to be in the spotlight. As well as 'red topping' companies with less than 30% gender diversity on their board, IVIS is 'red topping' if it is not seeing gender diversity at the level below board directors.

It will be interesting to see if institutional investors add to the pressure, wanting companies to take more action to develop the pipeline of female talent. It’s still significant to vote against the chair of the board based on diversity concerns alone and usually only happens when coupled with governance concerns in other areas.

And so to ethnic diversity. The Nomination Committee chair, in considering board composition, needs to explain the plan to meet the Parker Review target, if not already met, to avoid receiving negative vote recommendations for their re-election from ISS and Glass Lewis. As the Chair is normally the Chair of the Board, it’s not difficult to see how these multiple governance areas could ultimately result in investors voting against the Chair of the Board. Not a comfortable situation from anyone’s perspective.

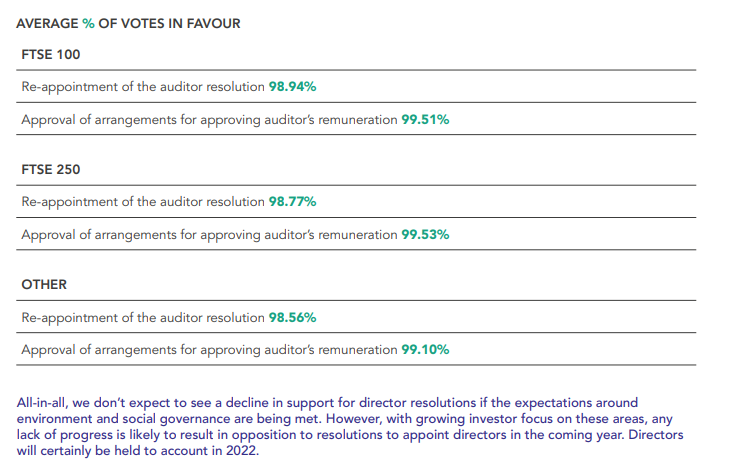

Nearly 50% more companies received the lowest number of votes out of all the resolutions for re-appointing auditors and approving arrangements for their remuneration in 2021.

Governance

Another area of governance that may come under the microscope is companies’ preparedness for black swan events. It’s possible that we will see questions about what has been learnt over the last two years and what is being done to prepare for further such upheavals.

And what about the independent review and performance of auditors? Auditor re-election could also be an area where companies receive more dissent. In 2021, nearly 50% more companies received the lowest number of votes out of all the resolutions for re-appointing auditors and approving arrangements for their remuneration2.

All-in-all, we don’t expect to see a decline in support for director resolutions if the expectations around the environment and social governance are being met. However, with growing investor focus on these areas, any lack of progress is likely to result in opposition to resolutions to appoint directors in the coming year. Directors will certainly be held to account in 2022.

ESG Tips for 2022

Set the strategy and clear governance framework:

- Be clear on the long term ESG aspirations of your company and the metrics that measure that

- Ensure there is clear, senior responsibility

- Collaborate fully across finance, risk, sustainability, governance and operations – internally and through the supply chain.

Get into the details:

- Improve your reporting by building on last year. Help stakeholders understand the direct and indirect impact on the business

- Investigate how your peer group companies are reporting – what level of granularity are they going into?

- Study your data as investors will base decisions on it even if there are clear flaws

- Uncover the innovation happening in your company and shine a light on it

- Be aware of the influence of ESG rating agencies to understand how external stakeholders are assessing your performance and where to focus disclosure efforts

- Temperature check your communications to ensure the message lands how you want it to.