Patricia Aizpurua Martin

Corporate Governance Manager

Patricia Aizpurua Martin

Corporate Governance Manager

Climate Change - Focusing On The ‘E’ In ESG

As we highlighted in November’s update, both social and environmental factors are increasingly becoming a major focus of governments, regulators, investors and companies. Given the recent COP26 conference held in Glasgow, and the intensification of interest in the environmental risks and opportunities, in December’s update we outline the key aspects of the integration of climate change within corporate governance, as well as the main COP26 conclusions.

Further information around ESG can be found in November’s EQ Bulletin, which focuses on ESG and sustainability, including the FRC's findings around its carbon reporting review and the publication of FAQs on international sustainability standards-setting.

To access the Governance Update Series, please visit: https://boudiccaproxy.com/thought-leadership/

In This Edition:

- The ‘E’ In ESG

- Climate Related Reporting

- ‘Say On Climate’ Initiative

- Proxy Adviser And Investor Perspectives On Climate Change

- COP26 Conclusions

- A Step Change In Attitudes, A Step Change In Disclosure - Special Commentary By Emperor

Thought for December

“Meeting ambitious climate targets is as much about engagement and culture as it is about credible metrics, measuring and reporting.” - Emperor

Dates for Your Diary:

- In January’s Proxy Governance Update we will present our 2021 AGM End of season review

Hear from our in-house Corporate Governance Manager, Cormac Chesser, who will provide you with key findings from this year’s proxy voting season.

If you would like to receive our regular updates directly into your inbox, please email: info@boudiccaproxy.com

The ‘E’ In ESG

As shown by the intense media interest in the recent COP26 conference in Glasgow, global warming is seen as a universal existential threat, and investors are increasing pressure on investee companies to lower their carbon emissions. As part of their oversight of their investment portfolios, shareholders expect companies to disclose information on their carbon emissions and set targets to reduce carbon emissions from their operations to net zero, in line with the Paris Agreement of 2015. Activist shareholders have sought change through shareholder resolutions, such as the emerging initiative ‘Say on Climate’, promoted by Chris Hohn through the Children’s Investment Fund Foundation (CIFF).

In light of this increasing scrutiny, we pose the following key questions

- How are companies expected to report on their efforts to limit their environmental impacts?

- What is the ‘Say on Climate’ initiative? How has it been received by companies, shareholders and proxy advisers?

- What are the views of proxy advisers and investors on climate change?

- What are the main conclusions of COP26? What are the next steps towards net zero?

We end this article with a special commentary by Emperor, discussing disclosures on climate change.

Climate-Related Reporting

Thanks to landmark studies such as ‘Who Cares Wins’ (2004) and the Freshfields Report (2005), environmental factors have gained greater significance within the investment industry, leading to a growing interest among investors in how their investee companies address ESG issues. While some might think that ESG factors are immaterial in the generation of financial returns, it has been demonstrated that these factors are positively related to corporate financial performance.

After reviewing the UK voting policies of the most typical investors across issuers’ shareholder registers, we have observed, in line with the Paris Agreement's goals, that approximately 50% of the shareholders expect companies to report against TCFD disclosures and 25% expect the use of the SASB framework. Furthermore, we have also noted some shareholders who expect to see disclosures and commitments around United Nation Global Compact (UNGC) and Global Reporting (GRI).

Paris Agreement

The Paris Agreement provides the overarching global target to maintain global warming at or below the level currently being experienced. The Paris Agreement followed the Kyoto Protocol, which expired in 2020, and is a result of the Conference of the Parties to the United Nations Framework Convention on Climate Change (UNFCCC) which met in Paris in December 2015 (COP21). In Paris, 196 Parties reached an agreement whose main long-term goal is to limit global warming to well below 2˚C above pre-industrial levels, limiting the increase to 1.5˚C. Under the Paris Agreement, countries committed to set national plans to reduce their emissions, which have been updated at the recent COP26.

Task Force on Climate-related Financial Disclosures (TCFD)

In 2015, the G20 Finance Ministers and Central Bank Governors asked the Financial Stability Board (FSB) to review how the financial sector could consider climate-related issues. This led to the establishment of the TCFD, which developed disclosures to improve reporting of climate-related risks to support progress towards the Paris Agreement’s goals.

In 2017, the TCFD released their final report with recommendations to help companies to disclose climate-related financial information. These recommended disclosures were based on 11 questions within the key four pillars defined by the TCFD: Governance, Strategy, Risk Management, and Metrics and Targets. In the same year, they also published guidance for implementing those recommendations in all sectors and for the use of scenario analysis to better understand how resilient a company is when facing different future scenarios.

Since then, the TCFD has released additional supporting material and yearly Status Reports which can be found within the TCFD resources. In 2021, the TCFD published a summary of changes in relation to their implementing guidance and new guidance on Metrics, Targets and Transition Plans. This framework has more than 2,600 supporters, and further guidance around TCFD disclosures continues to emerge, including the guide recently published by the London Stock Exchange Group for London-listed companies.

In 2019, the UK government set out its expectation for all listed companies and large asset owners to disclose in line with the TCFD recommendations by 2022 in its Green Finance Strategy report. Later in November 2020, the UK Government announced that climate risk reporting, in line with TCFD disclosures, will become mandatory across the UK economy by 2025. In its Interim Report, the UK Government sets out its roadmap towards mandatory TCFD-aligned disclosures, with deadlines by the end of 2021 for occupational pension schemes (>£5bn), premium listed companies and banks, buildings societies and insurance companies.

Sustainability Accounting Standards Board (SASB)

SASB develops sustainability accounting standards based on a broader scope of ESG topics within 77 industries. It can be used by companies to implement the TCFD disclosures and communicate financially material sustainability information to investors. These standards are also useful for investors, not only for disclosure, but also as a tool to develop ESG scores and drive ESG integration.

'Say On Climate’ Initiative

"We were delighted to receive 99% shareholder support for our climate change commitments and targets at the 2021 AGM" Megan Barnes, Head of Company Secretariat, National Grid plc

In 2020, the hedge fund activist investor Chris Hohn’s CIFF launched the ‘Say on Climate’ initiative. This initiative requests that companies disclose their Climate Transition Plans and put it as a non-binding resolution to shareholder vote, in a similar manner to existing ‘Say on Pay’ votes. The initiative is supported by around 20 companies and asset managers, seven asset owners and supporting partners such as the CIFF, CDP, ShareAction and the Australasian Centre for Corporate Responsibility (ACCR).

The ‘Say on Climate’ initiative states that to manage the transition to net zero, companies need:

- Annual disclosure of emissions

- A plan to manage those emissions

- An approval or disapproval vote where shareholders deem it appropriate

According to the Financial Times, Aena, Spanish leading airport operator, became the first company in the world to adopt a ‘Say on Climate’ initiative through a management resolution at its 2021 annual meeting, which was supported by 96.4% of the votes cast. As Table 1 displays, similar results have been observed in the UK market[1]. The table includes results for 2021 only and shows that there were nine ‘Say on Climate’ resolutions’ proposed by the management team, being mostly FTSE 100 companies.

Table 1: ‘Say on Climate’ proposals in the UK (sorted by most recent date order)

|

Say on Climate Vote [M] |

||||

|

Company |

Index |

Meeting date |

For % |

Against % |

|

Ninety One plc |

FTSE 250 |

04/08/2021 |

97.38 |

2.62 |

|

National Grid PLC |

FTSE 100 |

26/07/2021 |

99.00 |

1.00 |

|

SSE PLC |

FTSE 100 |

22/07/2021 |

99.96 |

0.04 |

|

Severn Trent PLC |

FTSE 100 |

08/07/2021 |

99.44 |

0.56 |

|

Royal Dutch Shell PLC (A) |

FTSE 100 |

18/05/2021 |

88.74 |

11.26 |

|

Royal Dutch Shell PLC (B) |

FTSE 100 |

18/05/2021 |

88.74 |

11.26 |

|

Aviva plc |

FTSE 100 |

06/05/2021 |

99.95 |

0.05 |

|

Unilever PLC |

FTSE 100 |

05/05/2021 |

99.58 |

0.42 |

|

Glencore Plc |

FTSE 100 |

29/04/2021 |

94.36 |

5.64 |

Proxy Adviser And Investor Perspectives On Climate Change

Proxy advisers and shareholders have developed their own approaches towards environmental issues, including climate change, based on market practice and regulatory disclosures. Furthermore, it is worth noting that a group of investors have sent a letter to the Big Four audit firms ahead of COP26. In this letter, shareholders including Aviva Investors, Sarasin & Partners, Pictet, RPMI Railpen and other pension schemes have stated their intention to vote against the re-appointment of these audit firms if they do not start considering climate change in their audits. The Big Four have recognised their key role factoring that climate-related risks are properly accounted for and disclosed in the financial statements and annual report.

Having reviewed the most recent UK voting guidelines as at 10 December 2021 of the main proxy advisers (ISS, Glass Lewis, IVIS and PIRC) and five of the top investors in the UK market (BlackRock, Vanguard Group, Legal & General, State Street Global Advisors (SSGA) and Norges Bank Investment Management (NBIM)), we found several areas within corporate governance where they expect companies to embed climate change.

Please note that given that we are currently in a period of voting policy updates we recommend readers continue to check for the latest policies as we move into 2022. Information is correct as at 10 December 2021.

Proxy advisers

Annual Reports and Accounts – IVIS and PIRC expect companies to reflect their climate-related matters in their Annual Reports and Accounts and make a statement of the company’s environmental approach and resilience to climate change. Additionally, PIRC will only consider that companies have adequately quantified carbon emissions if they have provided quantified figures for all direct and indirect emissions (all three scopes).

Climate Reporting – In terms of climate reporting, IVIS will Amber Top the ESG report of all companies in a high-risk sector that do not address all four pillars of TCFD. Likewise, to understand and mitigate climate change risks, ISS will require two minimum criteria for 2022: to comply with the TFCD framework and appropriate GHG emission reduction targets. Glass Lewis are likely to support shareholder resolutions requesting that companies provide enhanced disclosure on climate-related issues, including undertaking a scenario analysis or reporting against TCFD recommendations. However, they will not support such resolutions if they believe that a company’s existing climate policies or reporting sufficiently address the request of the resolution.

Board Oversight – ISS and Glass Lewis will recommend shareholders to vote against the directors who are accountable for the oversight of ESG matters if the board has failed to properly manage environmental and social issues. Specifically in relation to climate change, ISS will generally recommend a vote against the board chair for companies in the following circumstances: those that are significant greenhouse gas (GHG) emitters, through their operations or value chain, who are not taking the minimum steps needed to understand, assess, and mitigate risks related to climate change to the company and the larger economy. On disclosures on Board oversight, Glass Lewis will generally recommend voting against the governance committee chair (or equivalent) of FTSE 100 companies that fail to provide explicit disclosure concerning the board's role in overseeing material environmental and social issues. Also, they will note a concern when boards of FTSE 250 companies have failed to provide explicit disclosure in this regard. Furthermore, in the absence of explicit board oversight of environmental and social issues, Glass Lewis will recommend voting against members of the audit committee. PIRC will expect companies to identify a board member or board level committee responsible for environmental and social issues.

Executive Remuneration – Proxy advisers support the incorporation of appropriate non-financial performance metrics in executive variable remuneration programs. Nonetheless, companies should explain the link between these ESG metrics and the company’s long-term strategy, and targets should be material to the business and quantifiable. As Glass Lewis highlight, companies should retain flexibility in not only choosing to incorporate E&S metrics in their remuneration plans, but also in the placement of these metrics. Glass Lewis note that, while ESG factors are often considered as long-term goals, some companies may consider it more appropriate to include ESG metrics in their annual bonus programs. Likewise, IVIS state that where companies have incorporated ESG risks and opportunities into their long-term strategy but have not yet incorporated ESG metrics into their remuneration structures, they should explain to shareholders how they will be incorporating ESG metrics into the remuneration structure and the approach they will take in future years.

Say on Climate resolutions – Glass Lewis has stated that they will generally recommend against shareholder proposals requesting that companies adopt a Say on Climate vote. This is due to Glass Lewis having some concerns around the fact that climate strategy is part of the company’s long-term business strategy, which they believe falls within the bounds of matters reserved to the board. When evaluating management proposals of climate transition plans, Glass Lewis will consider the information provided by the board concerning the governance of the Say on Climate vote. As such, in instances where disclosure concerning the governance of the Say on Climate vote is not present, they will either recommend that shareholders abstain, or, depending on the quality of the plan presented, will recommend that shareholders vote against the proposal.

On the other hand, ISS will assess both management and shareholder proposals on a case-by-case basis. For management proposals that request shareholders to approve the company’s climate transition action plan, ISS will consider information available including climate-related disclosures and commitments made around climate change. We recommend that readers of this article review the full policy update available here. Likewise, for shareholder proposals, ISS will review proposals that request: (i) the company to disclose a report providing its GHG emissions levels and reduction targets and/or its upcoming/approved climate transition action plan; (ii) that shareholders have the opportunity to express approval or disapproval of its GHG emissions reduction plan. ISS will consider various information in relation to the Company’s current disclosures, any recent issues related to GHG emissions and whether the proposal request is unduly burdensome.

Shareholder Resolutions – Generally, proxy advisers will analyse ESG shareholders proposals on a case-by-case basis. They will take into account several factors when evaluating these proposals, as well as considering their financial materiality and whether their implementation is likely to enhance and protect shareholder value.

Investors

Climate Reporting – BlackRock, SSGA, Legal & General and NBIM expect companies to report against TCFD recommendations. Additionally, the first two mentioned also encourage companies to report using the SASB framework. Other initiatives to be considered by companies such as Sustainable Development Goals (SDGs), Science Based Targets (SBTi), CDP and GRI are also highlighted among these shareholders. In the case of Legal & General, climate reporting goes a step further as companies that do not meet their minimum standards on climate change strategy and disclosure may be subject to voting sanctions, and ultimately divestment from Legal & General’s Future World range of funds. Also, from 2022, they will be voting against any LGIM Transparency score laggards (Legal & General’s ESG score).

Board Oversight – While Vanguard and SSGA expect companies to disclose how the board oversees climate-related matters, BlackRock and NBIM go further using their voting power in director elections. As such, NBIM will not support the re-election of a director, or the entire board, if the company has experienced material failures in the oversight, management or disclosure of sustainability risks. BlackRock will hold members of the relevant committee, or the most senior non-executive director, accountable for inadequately disclosed and demonstrated ESG responsibilities.

Executive Remuneration – Legal & General states that remuneration committees should apply minimum ESG targets as performance moderators to financial performance payouts. BlackRock, for their part, specify that if ESG criteria is used, it should be linked to material issues and should reflect the strategic priorities of the company. For that reason, they do not consider the inclusion of targets based on ESG-indexes to be appropriate.

Shareholder Resolutions – Generally, these five investors have a similar approach towards ESG shareholders proposals. They will support shareholders resolutions asking for enhanced disclosure when these are aligned to their expectations and linked to long-term shareholder value, and/or request reasonable and material disclosure.

COP26 Conclusions

The 26th UN Climate Change Conference of the Parties (COP26) took place in Glasgow between 31 October 2021 to 12 November 2021. The resulting statements and declarations include the following outcomes and commitments:

- The Glasgow Breakthroughs Agenda, including goals around power, road transport, steel, hydrogen and agriculture to be achieved by 2030.

- The Declaration on Forests & Land Use to halt and reverse forest loss and land degradation by 2030.

- The Just Energy Transition Partnership to support South Africa’s decarbonisation efforts.

- The Global Methane Pledge to reduce global methane emissions by 30% by 2030.

- End of international public support for the unabated fossil fuel energy sector by the end of 2022

- 26 nations to change their agricultural policies to become more sustainable and less polluting.

- Integration of sustainability and climate change in formal education systems and professional training.

- 47 countries to build sustainable health systems to withstand the impacts of climate change.

- National gender commitments to embed gender equality within climate action.

- The Clydebank Declaration to support the establishment of green shipping corridors between two ports.

- Automotive industry to achieve 100% new cars and vans being zero emission by 2040 or earlier.

- Advance ambitious actions to reduce aviation CO2 emissions.

- The Urban Climate Action Programme to support cities across Africa, Asia and Latin America to become carbon neutral by 2050.

A Step Change In Attitudes, A Step Change In Disclosure - Special Commentary By Emperor

By Claire Fraser, Head of Stakeholder Communications, and Rachel Crossley, Director of Stakeholder Communications.

COP26 was the culmination of a year that’s seen greater scrutiny and higher expectations of companies in relation to climate change and climate action. Especially when it comes to disclosure.

A FTSE 350 perspective

What we’re seeing

We’ve followed the evolution of mainstream FTSE 350 climate disclosure over the past three years and have witnessed a notable change over the past 12 months.

Governance and risk management

On the governance front we’re seeing more ownership of climate as a topic. For the majority of companies in our research set[2] the CEO now has ultimate responsibility for climate risk. This is a significant change from our previous research where accountability often sat with the sustainability, CSR or risk team. We’re seeing more evidence of companies establishing climate‐focused board or sub-committees and appointing non‐executive directors with specific experience in climate science, transition planning and implementation. We’re also seeing more companies appointing a Chief Sustainability Officer, or an equivalent executive sponsor, and introducing additional steering and working groups at an operational level.

Over half (52%) of companies now have a dedicated sub‐committee for sustainability and/or climate change. Those without sub‐committees identified other changes to help boards understand climate-related issues.

A relatively small number of companies describe the impact of climate change across their entire risk register. We found a notable difference between companies discussing climate change as a principal risk (56%), versus those who still refer to it as an emerging risk (12%), and nearly a third (32%) do not identify climate change at all in their risk report.

Given the interconnected nature of risk factors and impacts, it is increasingly important for companies to consider the interdependencies between environmental, social and economic risks.

Plans with substance – Strategy, metrics and targets

Scenario analysis and the quantification of climate‐related risks and opportunities are the most challenging aspects of the TCFD recommendations. 20% of companies disclose information on scenario analysis across a variety of short, medium to long‐term timeframes. Whilst we've seen almost a third (31%) of businesses communicate around financial impact – only 11% have quantified the impact.

Beyond mandatory requirements, climate‐related metrics varied across companies and sectors. Companies who are adapting fast, understand that their future resilience depends on meeting science-based climate and sustainability targets.

We saw encouraging examples of companies who are focusing on partnerships, joint initiatives and collaborations to help them achieve progress, especially around Scope 3 emissions in supply chains. Some companies enhanced their membership of organisations who are advocating for climate action. And several companies undertook direct engagement with key stakeholder groups, including Climate Action 100+.

Most (68%) companies have announced some sort of net zero commitment, but the ambition, timeframes and robustness of strategies to achieve these varies wildly. 36% of companies are targeting net zero by 2030 vs 20% who are targeting net zero by 2050.

The TCFD has recently published updated guidance for companies on Metrics, Targets and Transition Plans. Ultimately, equity and debt investors want to understand a company’s transition strategy and capital investment plans.

Mondi disclose the financial impact of both risks and opportunities and provide an overview on actions in place to support these findings. They look at both physical and transitional risks, which include an overview on how regulatory changes and climate‐related water stress will impact on their financial performance, but also at the opportunities which they are able to capitalise on – including costs reductions and savings in energy, and resource efficiency measures which will be financially beneficial in the longer term.

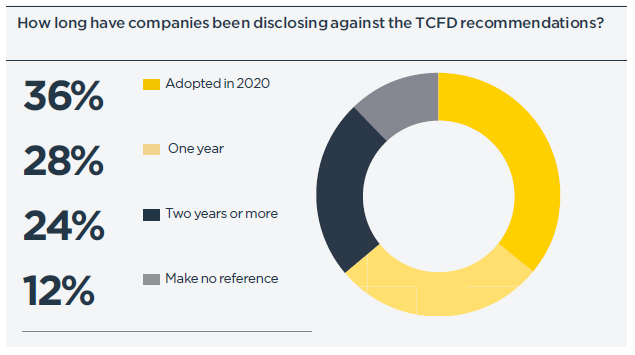

How long have companies been disclosing against the TCFD recommendations

How long have companies been disclosing against the TCFD recommendations

Source: Navigating the sustainability odyssey: Trends and insights from the First 25 December year ends

Since the FCA confirmed its expectation for premium UK-listed companies to disclose in line with the TCFD recommendations from 1 January 2021 this has driven a rapid uptake, with 36% of companies adopting the recommendations in 2020.

Outside of financial services and the extractive industries, a surprisingly high number of FTSE 100 companies only adopted the TCFD recommendations last year. This is particularly surprising because globally, other markets have been championing alignment for several years. Of those who did adopt in 2020, on the whole, we observed a concerted effort to put the right systems and processes in place.

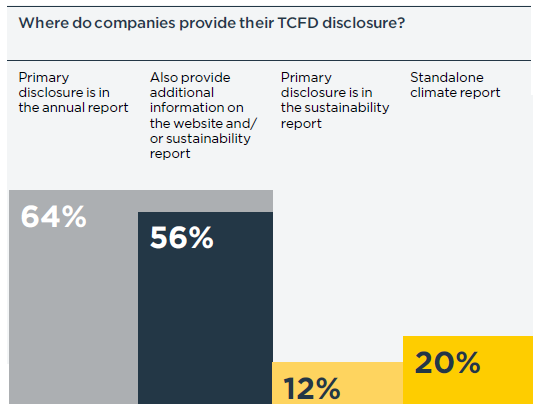

Where do companies provide their TCFD disclosure?

Source: Navigating the sustainability odyssey: Trends and insights from the First 25 December year end

The primary location for TCFD disclosures is the annual report. The majority of companies also provide additional or supplementary information on the website, and/or in their sustainability report. More established reporters, particularly companies in the banking (Natwest, Barclays, HSBC, Standard Chartered, Bank of England, ING), insurance (Legal & General, Aviva, Direct Line) and mining (BHP, Rio Tinto) sectors also produce a standalone climate or TCFD report.

Only 12% of companies used their sustainability report as the primary location for TCFD disclosures. We observed that information in sustainability reports was often a duplicate or replica of information in the annual report, which raises some interesting questions about the purpose of corporate vs sustainability reporting, particularly where information is financially material. Sustainability reports do often have more detail around metrics and performance – however progressive companies are demonstrating the strategic relevance of their climate‐related metrics and targets.

What are the most important things to get right?

The purpose of reporting is to measure progress and performance. More progressive companies are generally ahead of the curve in terms of their thinking and planning in relation to climate risk and opportunities. Laggards are responding to the current pressure to enhance disclosure but aren’t necessarily putting the right systems and processes in place.

We see many companies who disclose the bare minimum in terms of compliance, however this doesn’t always help stakeholders to understand the direct and indirect impact on the business. To address this effectively requires real collaboration across finance, risk, sustainability, governance, operations etc, even at a functional level within businesses, but also partnerships and joint initiatives with everyone in the supply chain, industry peers, governments etc.

Data gathering is incredibly important to assess and quantify financial impacts.

A small cap perspective

What we’re seeing

Until recently, many AIM and small cap companies, especially those in traditional low impact sectors, have done little in the way of disclosure on ESG issues as a whole and climate change in particular. But this has changed rapidly over the past two years and ESG issues have moved rapidly up the agenda, driven by growing demand for information from investors and other stakeholders.

The regulatory environment has also supported this shift. Regulations are increasingly based on size rather than listing so recent reporting requirements, such as Streamlined Energy & Carbon Reporting, not only apply to main market listed companies but to AIM listed and private companies too above a certain size (250 employees, annual turnover greater than £36m and/or annual balance sheet total greater than £18m).

As a result of these developments, smaller companies have increased both the quality and quantity of their ESG reporting. In our white paper on AIM 100 reporting published earlier this year[3], we found that 52% of our sample identified material issues within the report (up from just 12% last year), with the issues falling mostly under the umbrellas of planet, people and community. 21% of companies had an established sustainability strategy with forward-looking commitments or targets, while around a quarter (24%) are in the process of developing a more formal approach to their reporting.

Climate disclosure

As AIM companies look to develop sustainability strategies and reporting, they are also starting to consider climate disclosure. This trend has been accelerated by the UK Government’s announcement in October this year that it will make it mandatory for all companies, including AIM and private companies, with over 500 employees and more than £500m in annual turnover to disclose in alignment with TCFD from 6 April 2022. This will be extended to apply to all AIM companies by 2025.

However, disclosure currently lags significantly behind main market disclosure and is very much in its infancy. For many companies, climate reporting is only just making it onto their radar. According to our AIM 100 white paper, 21% currently reference TCFD, only one company reports against the full TCFD recommendations and no one sets out a net zero strategy.

Many companies simply namecheck TCFD and provide an overview of plans to develop full disclosure in the future. Those that reported on climate change tended to start with a high-level overview of climate-related risks and opportunities that could impact the company, usually as part of a discussion on emerging risks.

Board level oversight of sustainability and climate change is on the increase as companies establish ESG or sustainability committees or nominate a non-executive director to focus on ESG matters.

24% of our sample have established, or are in the process of establishing, a board committee or subcommittee focused on sustainability. These committees are charged with helping boards understand and evolve their approach to sustainability and climate-related issues.

What are the most important things to get right?

While the same principles apply as for larger companies, the most important factor for smaller companies as they start to evolve their strategy and disclosure is to put the right building blocks in place. First and foremost, recognise this is a journey that will take time and report on your progress in a clear and credible way, setting out where you are on the journey and what your future plans are.

While there’s a lot to consider, you don’t have to do it all at once. It’s a long-term commitment which enables you to meet increasing stakeholder demands and make the most of the opportunity to demonstrate your business is fit for the future.

Our top tips for companies:

- Get the right people on board - needs cross-function collaboration and buy in from sustainability, operations, finance, legal and IR teams

- Develop and implement a disclosure roadmap

- Explain how climate change has been considered in the context of long-term success

- Measure progress and explain how targets and metrics fit into the company’s broader strategic approach

- Define your ambition, and be transparent about your progress and performance

- Communicate in a way that’s clear and understandable to different stakeholders – not everyone understands the technical nuances around climate science

Regulator, investor and stakeholder expectations will only increase. The opportunity is to use the newly raised bar to get ahead of the curve and improve disclosures in line with the latest guidance.

And finally, meeting ambitious climate targets is as much about engagement and culture as it is about credible metrics, measuring and reporting. In our experience of working with large and small companies on sustainability, we’ve found that employees are willing and passionate about strengthening the sustainability purpose of their companies. Employee engagement is therefore critical in shifting the culture of a company, to bring about meaningful change.

About Emperor

Emperor is a strategic communications agency specialising in stakeholder disclosure and engagement, brand and employee experience. They deliver work across all forms of media including digital, print, video and presentation. They work with over 200 public and private companies of all sizes across the UK and Europe, providing corporate and sustainability disclosure and engagement services and advice.

For more information please see Emperor’s website www.emperor.works or contact Claire Fraser on claire.fraser@emperor.works or Rachel Crossley on rachel.crossley@empeoror.works.

Conclusion

Considering the broadness and depth of this topic, this article has outlined the main ongoing initiatives and actions around climate change. Additionally, thanks to the insight provided by Emperor, we have a more comprehensive knowledge of how UK companies are currently addressing climate reporting.

At the COP26, we have seen how governments, regulators, investors and businesses have come together and agreed to work towards the acceleration of climate action, which will lead to higher expectations around climate-related financial reporting. As a result, below we highlight some of the actions around climate-related financial reporting we expect to observe during the next proxy season:

- Occupational pension schemes (>£5bn), premium listed companies and banks, buildings societies and insurance companies required to meet the 2021 deadlines for disclosures.

- ‘Say on Climate’ initiative to be a growing trend among management teams and investors.

- Shareholders and proxy advisers to focus attention and highlight issues when companies fail in meeting their expectations around ESG oversight and minimum disclosures.

Our Corporate Governance Advisory team are available for consultation should further assistance be required in understanding the views and policies of the main proxy advisers and institutional investors on this topic.

[1] The study covers all FTSE indexes available in Proxy Insight during 2018 - September 2021.

[2] In July 2020, we conducted in‐depth research and analysis of climate disclosures across the FTSE350 in our white paper, Shaping the climate conversation. We updated this research in April 2021 to see how companies are progressing in our white paper, Navigating the sustainability odyssey, and there’s been a notable shift in the number of companies now talking about climate change as the biggest threat of our time.

[3] Our white paper, Seeing the bigger picture, provides an overview of AIM 100 corporate reporting based on annual reports published before 31 May 2021.

Anne-Marie Clarke, ACG (she/her)

Head of Corporate Governance

T: +44 (0) 207 099 2075

D: +44 (0) 203 048 1199

M: +44 (0) 795 8430 361

E: Anne-Marie.Clarke@boudiccaproxy.com

W: BoudiccaProxy.com

Olayinka Agbede, ACG

Principal Corporate Governance Officer

T: +44 (0) 207 099 2075

D: +44 (0) 203 048 1204;

M: +44 (0) 780 7265 224

E: Olayinka.Agbede@boudiccaproxy.com

W: BoudiccaProxy.com